Clark Wealth Partners Things To Know Before You Buy

Some Known Details About Clark Wealth Partners

Table of ContentsGetting The Clark Wealth Partners To Work6 Simple Techniques For Clark Wealth PartnersRumored Buzz on Clark Wealth PartnersThe 9-Minute Rule for Clark Wealth PartnersAll About Clark Wealth PartnersFascination About Clark Wealth PartnersThings about Clark Wealth Partners

The world of finance is a complicated one., for instance, lately located that nearly two-thirds of Americans were not able to pass a basic, five-question monetary literacy test that quizzed individuals on subjects such as passion, financial obligation, and various other relatively fundamental concepts.Along with managing their existing clients, financial consultants will certainly usually invest a fair quantity of time each week meeting with potential clients and marketing their solutions to retain and expand their service. For those considering ending up being a financial advisor, it is vital to think about the average income and job stability for those working in the field.

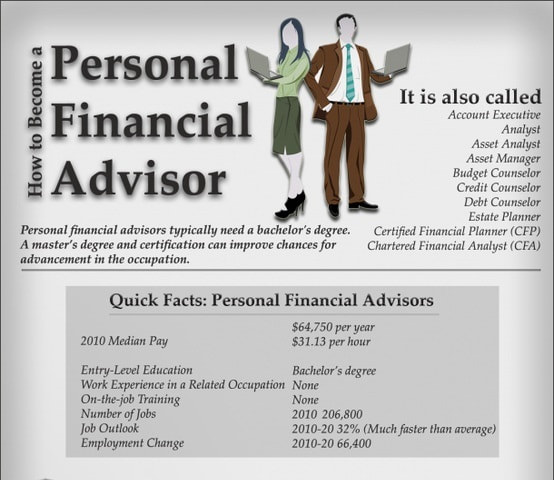

Courses in tax obligations, estate planning, financial investments, and risk administration can be valuable for pupils on this path too. Relying on your unique occupation objectives, you may also require to gain particular licenses to satisfy certain clients' requirements, such as dealing supplies, bonds, and insurance plan. It can additionally be handy to make a qualification such as a Licensed Financial Coordinator (CFP), Chartered Financial Expert (CFA), or Personal Financial Expert (PFS).

The Main Principles Of Clark Wealth Partners

What that looks like can be a number of points, and can vary depending on your age and stage of life. Some people fret that they require a particular quantity of money to spend prior to they can get assist from a specialist (financial advisor st. louis).

An Unbiased View of Clark Wealth Partners

If you haven't had any experience with an economic expert, here's what to expect: They'll start by giving an extensive assessment of where you stand with your possessions, responsibilities and whether you're satisfying criteria compared to your peers for cost savings and retirement. They'll examine brief- and long-term goals. What's valuable concerning this step is that it is individualized for you.

You're young and functioning complete time, have a cars and truck or 2 and there are trainee financings to pay off.

The Of Clark Wealth Partners

Then you can review the next finest time for follow-up. Prior to you begin, ask concerning pricing. Financial consultants typically have different tiers of prices. Some have minimal possession levels and will charge a charge normally a number of thousand dollars for creating and adjusting a strategy, or they might bill a flat fee.

You're looking ahead to your retired life and assisting your children with greater education and learning expenses. A monetary expert can provide guidance for those situations and more.

Clark Wealth Partners Can Be Fun For Anyone

Arrange regular check-ins with your coordinator to tweak your plan as required. Balancing savings for retirement and university costs for your children can be complicated.

Considering when you can retire and what post-retirement years may appear like can produce problems regarding whether your retirement savings remain in line with anonymous your post-work plans, or if you have actually conserved enough to leave a tradition. Aid your economic professional comprehend your strategy to cash. If you are more traditional with saving (and prospective loss), their tips ought to reply to your concerns and concerns.

Clark Wealth Partners Can Be Fun For Anyone

For instance, preparing for health and wellness treatment is one of the big unknowns in retirement, and an economic specialist can outline alternatives and recommend whether extra insurance as protection might be helpful. Prior to you start, attempt to obtain comfy with the concept of sharing your entire monetary image with an expert.

Providing your expert a full image can help them create a strategy that's prioritized to all parts of your monetary condition, specifically as you're quick approaching your post-work years. If your finances are basic and you have a love for doing it yourself, you may be great on your own.

An economic expert is not just for the super-rich; any individual encountering major life transitions, nearing retirement, or feeling bewildered by economic decisions could take advantage of expert guidance. This post discovers the role of monetary experts, when you may need to consult one, and essential considerations for selecting - https://www.bark.com/en/us/company/clark-wealth-partners/KNA896/. An economic advisor is a skilled expert who helps clients handle their financial resources and make notified choices that line up with their life objectives

The Buzz on Clark Wealth Partners

In contrast, commission-based consultants gain revenue with the financial items they sell, which might affect their referrals. Whether it is marriage, divorce, the birth of a kid, career changes, or the loss of an enjoyed one, these occasions have special financial implications, commonly needing prompt choices that can have lasting impacts.